Analysis of the Halal Pharmaceuticals Market: Assessment of Market Size, Trends, Statistics, and Competitors

Global Halal Pharmaceuticals Market by Dosage Form (Capsules, Tablets, Syrups, Powders, and Others), by Drug Class (Pain Management Drugs, Analgesics, Anti-inflammatory Drugs, Cardiovascular Drugs, Respiratory Drugs, Vaccines, and Others), by Distribution Channel (Retail Pharmacy, Hospital Pharmacy, and Online), and by Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Size, Share, COVID-19 Impact, Regional Analysis & Forecast Till 2030

Category - Healthcare

Report Code - OMR-H-203

Format: PDF, PPT, and Excel

Halal Pharmaceuticals Market Overview

Halal medications contain halal components and are manufactured following Islamic standards. Every halal-certified ingredient must be traceable. No component originating from pigs, alcohol, blood, predatory animals, human body parts, or insects may be included in a product. Animal-derived substances must be sourced from permitted animals killed following Islamic law. In addition, the substances utilized must be suitable for human consumption and should not be poisonous or processed with najis-contaminated equipment (impurity). In addition, halal pharmaceutical goods must be physically isolated from non-halal pharmaceutical products during preparation, manufacturing, handling, packing, storage, and distribution. The demand for halal medications increases as more Muslims become concerned about the origins of their prescription. In addition, the inclination towards organic and ecofriendly, healthy drugs and healthcare products, and the increase in usage of halal pharmaceuticals by Muslim populations around the world all contribute to the expansion of the halal pharmaceuticals market. However, a lack of knowledge, a low acceptance rate, and a stringent regulatory environment impede the expansion of the market for halal medicines. The COVID-19 pandemic has had a substantial impact on the market for halal pharmaceuticals. Muslims have become more hesitant to use non-halal medicines in response to the pandemic, increasing in demand for halal medicines.

Halal Pharmaceuticals Market Growth Factors

Growing Muslim Population to Boost Market Growth

A growing global Muslim population contributes to the market's rapid growth. According to studies, around one-quarter of the world's population, or approximately 1.8 billion people, are Muslims. Nevertheless, the existing supply of Shariah-compliant items is insufficient to meet their demand. In addition, the number of Muslims is projected to reach around 2,2 billion by 2030. As Muslims are the primary and largest consumers of Halal pharmaceuticals, the rising population is projected to increase the need for Halal pharmaceuticals in the coming years.

Moreover, Muslims are increasingly worried and discriminating over faith-compliant and authorized items, particularly pharmaceuticals. This is due to increased religious education and awareness, leading to a worldwide demand for this business. In addition, the rising spending power of Muslims also contributes to the global demand for Halal pharmaceuticals.

Growing Number of Halal Certified Companies and Rising Investments to Augment Market Growth

A variety of companies has recognized the potential in this market. All of the firms, not just CCM, sell halal food options. The need for high-quality, halal-certified multivitamins prompted the launch of Noor Vitamins in the United States. In addition to Halal-certified prenatal multivitamins made by a different US company, Nutrition Enhancement also produces Halal-certified multivitamins. Vivapharm, a new pharmaceutical company specializing in halal-approved products, has begun construction on a US$26 million, 100,000-square-foot manufacturing facility in the tiny Southeast Asian nation of Brunei. Brunei has a Halal Brand Programme to verify that products are suitable for Muslim consumption. Australia, the United States, and Singapore are among the nations that have recently begun investing in halal pharmacies in response to the rising demand for halal medications.

Halal Pharmaceuticals Industry Segmentation

Dosage Form

• Capsules

• Tablets

• Syrups

• Powders

• Others

Drug Class

• Pain Management Drugs

• Anti-inflammatory Drugs

• Cardiovascular Drugs

• Respiratory Drugs

• Vaccines

• Others

Distribution Channel

• Retail Pharmacy

• Hospital Pharmacy

• Online

Halal Pharmaceuticals Market Regional Segmentation

North America

o U.S.

o Canada

o Mexico

Europe

o Germany

o U.K.

o France

o Spain

o Italy

o Rest of Europe (RoE)

Asia Pacific (APAC)

o Japan

o China

o India

o South Korea

o Rest of APAC

Latin America

o Argentina

o Brazil

o Rest of Latin America

Middle East & Africa

o South Africa

o UAE

o Saudi Arabia

o Rest of MEA

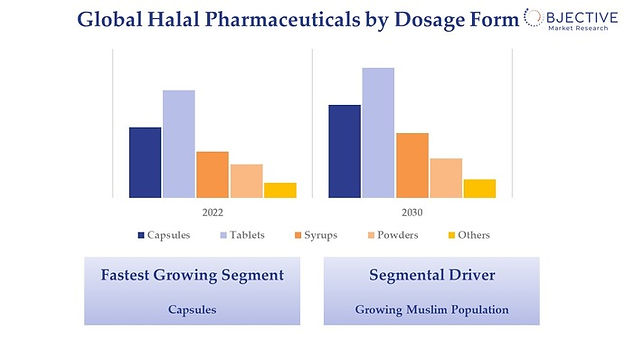

Dosage Form Insights

Tablets to Dominant the Halal Pharmaceuticals Market Growth Owing to Increasing Demand for this Type of Dosage among Patients

Based on dosage form, the market can be differentiated between capsules, tablets, syrups, powders, and others.

The tablet market is anticipated to grow the fastest throughout the foreseen period. This is owing to the extensive availability of tablets in various colors, forms, sizes, and kinds, such as film- and enteric-coated, effervescent, and orally disintegrating pills. The introduction of customized 3D-printed tablets also contributes to segment growth.

The capsule segment is expected to expand at a particularly rapid clip throughout the anticipated time frame. Faster disintegration is typical for capsules than for tablets. They might provide quicker symptom alleviation than pills. More of the drug is delivered to the circulation when taken in capsule form. Because of this, capsules may be more effective than tablets and are gain popularity among patients.

Drug Class Insights

Pain Management Drugs to Accommodate Largest Market Share Owing to Growing Number of Surgical Procedures

Based on drug class, the market can be split between pain management drugs, anti-inflammatory drugs, cardiovascular drugs, respiratory drugs, vaccines, and others.

Pain management drugs are expected to dominate the largest market share during the coming years. Patients, after surgeries or accidents, are given these types of drugs. Since adverse effects occur at a considerably greater incidence in patients with certain comorbidities, thus they must be monitored closely.

The vaccines segment will expand at the highest compound annual growth rate throughout the forecast period. The growing demand for halal vaccines, especially among the Muslim population, and the initiatives companies take to get their vaccines halal certified are among the factors boosting the market's growth. Moreover, the growing prevalence of various diseases and awareness regarding preventive measures will aid the segmental growth in the coming years.

Regional Insights

Asia Pacific to Lead Global Sales Owing to Extensive Infrastructure & High Traffic Congestion

Based on region, the market can be split between North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

The region of the Middle East and Africa and Asia Pacific is expected to indicate significant dominance during the forecast period. Due to the substantially Muslim populations in these regions, they are also the world's largest markets for Halal medications. Spending on Halal pharmaceuticals is highest in Turkey, Saudi Arabia, the United States, Malaysia, Indonesia, and Algeria.

The United Arab Emirates (UAE) has the highest rating for governance and price, making it the largest market for halal medicines. Regarding consumer expenditure, the largest markets for halal pharmaceuticals are Algeria, Turkey, Saudi Arabia, Indonesia, Algeria, the United States, and Malaysia. With a high governance and pricing index, the United Arab Emirates has become the largest market for halal medicines.

Emerging nations like India, Indonesia, Malaysia, Bangladesh, the Maldives, and Pakistan all have sizable Muslim populations in this area. The Malaysian government has issued a complete set of criteria with the release of the Malaysian Standard of Halal Pharmaceuticals: General Guidelines. This helps local pharmaceutical producers break into the lucrative international halal pharmaceutical industry and ensures the public's health and safety by providing pharmaceutical firms with the rules they must comply with.

Halal Pharmaceuticals Industry Analysis

The global market for halal pharmaceuticals is characterized by a significant supply base comprising several well-established regional and local companies. Nonetheless, the market is mostly dominated by multinational corporations striving to innovate regularly. They are investing extensively in research and development to produce more technologically sophisticated products. These firms are attempting to maintain and strengthen their current market positions through these initiatives.

Halal Pharmaceuticals Market Recent Developments

• In January 2021, when Indonesia began a mass immunization campaign using a Chinese vaccine, the country's highest Muslim religious council planned to judge whether the vaccine was halal or allowed under Islam. Since acquiring 3 million pills from Sinovac Biotech in China, the world's largest Muslim-majority country has planned to commence vaccines.

• In December 202, Pharmaniaga, a Malaysian pharmaceutical business, has announced that it intends to construct the world's first "halal vaccination" plant by 2022.

Global Halal Pharmaceuticals Market Prominent Players

• Noor Pharmaceuticals (U.S.)

• Bosch Pharmaceuticals (Pvt) Ltd. (Pakistan)

• Simpor Pharma Sendirian Berhad (Brunei)

• Chemical Company of Malaysia Bhd (Selangor)

• Viva Pharmaceutical (Canada)

• Duopharma Biotech Berhad (Malaysia)

• Zaytun Vitamins (U.S.)

• Pharmaniaga LifeScience Sdn Bhd (PLS) (Malaysia)

• SaudiVax (Saudi Arabia)

Frequently Asked Questions (FAQs)

At what rate will the Halal Pharmaceuticals Market Expand?

Objective Market Research says the global Halal Pharmaceuticals Market will expand at a CAGR of 9.6% during the forecast period.

What are the factors driving the global Halal Pharmaceuticals market?

The market for halal pharmaceuticals is primarily driven by rising concerns about the safety and quality of halal goods worldwide and rising attention to and awareness of the components used in medicine preparation.

Which segment accounted for the largest Halal Pharmaceuticals market share by drug class?

Pain management drugs are expected to dominate the largest market share during the forecast period the number of surgeries and accidents is growing.

What region holds the major share in the global market scape?

Asia Pacific & Middle East will hold the largest market share due to the region's rising vegan and growing Muslim population.

Which are the dominating players in the market during the forecast period?

Some of the prominent players in the global Halal Pharmaceuticals market are Noor Pharmaceuticals (U.S.), Bosch Pharmaceuticals (Pvt) Ltd. (Pakistan), Simpor Pharma Sendirian Berhad (Brunei), Chemical Company of Malaysia Bhd (Selangor), Viva Pharmaceutical (Canada), Duopharma Biotech Berhad (Malaysia), Zaytun Vitamins (U.S.), Pharmaniaga LifeScience Sdn Bhd (PLS) (Malaysia), SaudiVax (Saudi Arabia), and Others.

*Our reports are available on a region/wise and chapter/wise basis as well. For any additional personalization contact our sales representative directly at sales@objectivemarketresearch.com

Table of Content

1. Introduction

1.1 Market Definition

1.2 Objective of the Study

1.3 Market Scope

1.4 Years Considered in the Study

1.4.1 Historic Year: 2019-2021

1.4.2 Base Year: 2022

1.4.3 Forecast Period: 2023-2030

1.5 Currency Used in the Study

1.6 Boundaries for the Study

1.7 Collaborators/Stakeholders/Benefactors

2. Research Methodology

2.1 Research Outline

2.2 Data Collection Methods

2.3 Data Sources

2.3.1 Secondary Sources

2.3.1.1 Paid Sources

2.3.1.2 Unpaid Sources

2.3.2 Primary Sources

2.4 Market Estimation Methodology

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Data Triangulation

2.6 Assumptions of the Study

2.7 Limitations of the Study

3. Executive Summary

3.1 Market Outlook

3.2 Analysts Perspective

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers

4.1.1.1. Growing Vegan Population

4.1.1.2. Rising Muslim Population

4.1.2. Restrain

4.1.2.1. Stringent Regulations

4.1.3. Opportunities

4.1.3.1. Rising Environmental Awareness

4.1.4. Impact of Market Dynamics

4.2. Impact of COVID-19 pandemic

4.3. Value Chain Analysis

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Buyers

4.4.2. Bargaining Power of Suppliers

4.4.3. Threat of Substitution

4.4.4. Threat of New Entrants

4.4.5. Competitive Rivalry

5. Global Halal Pharmaceuticals Market Analysis & Forecast, by Dosage Form from 2019-2030 (in USD million)

5.1. Capsules

5.2. Tablets

5.3. Syrups

5.4. Powders

5.5. Others

6. Global Halal Pharmaceuticals Market Analysis & Forecast, by Drug Class from 2019-2030 (in USD million)

6.1. Pain Management Drugs

6.2. Anti-inflammatory Drugs

6.3. Cardiovascular Drugs

6.4. Respiratory Drugs

6.5. Vaccines

6.6. Others

7. Global Halal Pharmaceuticals Market Analysis & Forecast, by Distribution Channel from 2019-2030 (in USD million)

7.1. Retail Pharmacy

7.2. Hospital Pharmacy

7.3. Online

8. Global Halal Pharmaceuticals Market Analysis & Forecast, by Region from 2019-2030 (in USD million)

8.1. North America

8.1.1. North America Halal Pharmaceuticals Market Analysis & Forecast, By Country

8.1.1.1. U.S.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. North America Halal Pharmaceuticals Market Analysis & Forecast, By Dosage Form

8.1.3. North America Halal Pharmaceuticals Market Analysis & Forecast, By Drug Class

8.1.4. North America Halal Pharmaceuticals Market Analysis & Forecast, By Distribution Channel

8.2. Europe

8.2.1. Europe Halal Pharmaceuticals Market Analysis & Forecast, By Country

8.2.1.1. Germany

8.2.1.2. UK

8.2.1.3. France

8.2.1.4. Spain

8.2.1.5. Italy

8.2.1.6. Rest of Europe (RoE)

8.2.2. Europe Halal Pharmaceuticals Market Analysis & Forecast, By Dosage Form

8.2.3. Europe Halal Pharmaceuticals Market Analysis & Forecast, By Drug Class

8.2.4. Europe Halal Pharmaceuticals Market Analysis & Forecast, By Distribution Channel

8.3. Asia-Pacific (APAC)

8.3.1. Asia-Pacific Halal Pharmaceuticals Market Analysis & Forecast, By Country

8.3.1.1. Japan

8.3.1.2. China

8.3.1.3. India

8.3.1.4. South Korea

8.3.1.5. Rest of the APAC

8.3.2. Asia-Pacific Halal Pharmaceuticals Market Analysis & Forecast, By Dosage Form

8.3.3. Asia-Pacific Halal Pharmaceuticals Market Analysis & Forecast, By Drug Class

8.3.4. Asia-Pacific Halal Pharmaceuticals Market Analysis & Forecast, By Distribution

8.4. Latin America

8.4.1. Latin America Halal Pharmaceuticals Market Analysis & Forecast, By Country/Region

8.4.1.1. Argentina

8.4.1.2. Brazil

8.4.1.3. Rest of Latin America

8.4.2. Latin America Halal Pharmaceuticals Market Analysis & Forecast, By Dosage Form

8.4.3. Latin America Halal Pharmaceuticals Market Analysis & Forecast, By Drug Class

8.4.4. Latin America Halal Pharmaceuticals Market Analysis & Forecast, By Distribution Channel

8.5. Middle East & Africa

8.5.1. Middle East & Africa Halal Pharmaceuticals Market Analysis & Forecast, By Country/Region

8.5.1.1. South Africa

8.5.1.2. UAE

8.5.1.3. Saudi Arabia

8.5.1.4. Rest of Middle East & Africa

8.5.2. Middle East & Africa Halal Pharmaceuticals Market Analysis & Forecast, By Dosage Form

8.5.3. Middle East & Africa Halal Pharmaceuticals Market Analysis & Forecast, By Drug Class

8.5.4. Middle East & Africa Halal Pharmaceuticals Market Analysis & Forecast, By Distribution Channel

9. Competitive Landscape

9.1. Market Share Analysis (2022)

9.2. Market Positioning of Top Players (2022)

9.3. Key Developments & Growth Strategies (2020-2022)

9.3.1. Product Launches

9.3.2. Merges, Collaborations & Agreements

9.3.3. Expansion

9.4. SWOT Analysis

10. Company Profiles (Business Overview, Products Offered, Financial Details*, Recent Developments)

10.1. Noor Pharmaceuticals (U.S.)

10.1.1. Company Snapshot

10.1.2. Business Overview

10.1.3. Financial Data

10.1.4. Key Products Offered

10.1.5. Recent Developments

10.2. Bosch Pharmaceuticals (Pvt) Ltd. (Pakistan)

10.3. Simpor Pharma Sendirian Berhad (Brunei)

10.4. Chemical Company of Malaysia Bhd (Selangor)

10.5. Viva Pharmaceutical (Canada)

10.6. Duopharma Biotech Berhad (Malaysia)

10.7. Zaytun Vitamins (U.S.)

10.8. Pharmaniaga LifeScience Sdn Bhd (PLS) (Malaysia)

10.9. SaudiVax (Saudi Arabia)

11. Appendix

11.1. Currency Exchange Rate to USD

11.2. Abbreviations

* Financial details captured might be subjected to information available and not be given for privately-held companies or for companies that do not report it in the public domain