Analysis of the Heating, Ventilation, and Cooling (HVAC) System Market: Assessment of Market Size, Trends, Statistics, and Competitors

Global Heating, Ventilation, and Cooling (HVAC) System Market by Product (Heating, Ventilation, and Cooling), by Construction (New and Retrofit), by Application (Residential, Industrial, and Commercial), and by Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Size, Share, COVID-19 Impact, Regional Analysis & Forecast Till 2030

Category - Machinery & Equipment

Report Code - OMR-ME-248

Format: PDF, PPT, and Excel

Heating, Ventilation, and Cooling (HVAC) System Market Overview

A mechanical system, heating, ventilation, and air conditioning (HVAC) regulate indoor temperature and relative humidity. It improves indoor air quality and temperature. Central air conditioners, furnaces, boilers, rooftop sensors, heat pumps, chillers, and bundles are the most common types of HVAC equipment. During the predicted period, the HVAC market will be heavily influenced by changing climatic conditions and the requirement to manage a building's ambient atmosphere. Intelligent features and energy efficiency have been increasingly essential to consumers when purchasing in recent years, and this trend is predicted to increase. The HVAC industry is shifting its focus toward more energy-efficient practices. Green efforts are prioritized by some original equipment manufacturers (OEMs) as a means to save money and reduce GHG emissions. HVAC has progressed in recent years toward more eco-friendly models. Products that use less energy or run on renewable energy sources are included in this category. Market growth over the previous several years is expected to have been stunted by a lack of skilled HVAC specialists. As a result, HVAC systems should only be installed by trained technicians. There is a risk of increased repair costs or decreased efficiency if trained specialists do not install HVAC systems. The user is expected to have to pay more due to the need for specialist labor. As a result, it might stunt growth in the HVAC sector. Since its discovery in December 2019, the COVID-19 epidemic has wreaked havoc on economies worldwide.

Heating, Ventilation, and Cooling (HVAC) System Market Growth Factors

Hybrid HVAC Systems to Accommodate Widening Market Growth

The demand for HVAC systems is expected to rise in tandem with the popularity of combination systems. Automatic temperature regulation in reaction to external conditions is only one of many benefits of hybrid systems gaining favor. For instance, Carrier developed Carrier Hybrid Heat in October 2019, combining a gas furnace and an electric heat exchanger to adapt to different temperatures. As a bonus, the excellent thermal efficiency of these systems helps keep expenses low and generates healthy returns for investors. Hybrid systems are also gaining popularity with their lower environmental effect and longer service life. Because of IoT, HVAC systems may now be connected to the web to facilitate information exchange. System data is collected and stored in the cloud, HVAC operations are optimized for higher efficiency, and a predictive maintenance plan is implemented. Over the internet, it monitors, controls, and diagnoses gadgets without breaking the bank. Additionally, IoT enables inexpensive HVAC servicing and repairs. With the help of the Internet of Things, HVAC performance data may be accessed in real-time and properly interpreted. The industry is gradually shifting its attention back to increasing its goods' heating and cooling capacity while decreasing energy usage. Several OEMs emphasize environmental initiatives to lessen the production of greenhouse gases and cut expenses. In recent years, there has been a big effort toward more environmentally friendly temperature control systems that use less power and may be powered by renewable energy.

Technological Advances and Rising Regulatory Policies to Augment Definitive Market Growth

Smart thermostats and sensors that can be remotely controlled through applications are gaining appeal among consumers, especially in commercial buildings, because they reduce energy use and associated costs. The market for HVAC systems (heating, ventilation, and air conditioning) is predicted to grow. The use of more environmentally friendly appliances has gone mainstream. Reduced energy use in HVAC systems eases demands on power plants and lessens the need for fossil fuels. Many people choose HVAC systems because of their potential to act as the backbone of smart homes. Because of this, there has been a rise in the need for HVAC in manufacturing. By connecting sensors to a smart HVAC system, homeowners may regulate the temperature in any area of the house at any time. This is expected to fuel the expansion of the market. Growth of the HVAC industry is expected to be spurred by rising consumer demand for cutting-edge HVAC systems. The development of thermally powered air conditioners can be attributed to the rise in popularity of items with "green" labels, which can be attributed to increased environmental awareness. In addition to lowering the overall cost of ownership, this solution also makes it possible to independently regulate the temperature in each pipeline and make immediate modifications based on actual demand. Changing weather patterns significantly propel the HVAC industry forward by increasing the need for heating and cooling systems. Market expansion is anticipated because HVAC systems make homes and businesses aesthetically pleasing.

Heating, Ventilation, and Cooling (HVAC) Systems Industry Segmentation

Product

• Heating

o Heating Pump

o Boilers

o Furnaces

o Unitary Heaters

o Others

• Ventilation

o Ventilation Fans

o Humidifiers

o Air Filtration & Purification

o Dehumidifiers

o Others

• Cooling

o Cooling Tower

o Air Conditioners

o Chillers

o Others

Construction

• New

• Retrofit

Application

• Residential

• Industrial

• Commercial

Heating, Ventilation, and Cooling (HVAC) Systems Market Regional Segmentation

North America

o U.S.

o Canada

o Mexico

Europe

o Germany

o U.K.

o France

o Spain

o Italy

o Rest of Europe (RoE)

Asia Pacific (APAC)

o Japan

o China

o India

o South Korea

o Rest of APAC

Latin America

o Argentina

o Brazil

o Rest of Latin America

Middle East & Africa

o South Africa

o UAE

o Saudi Arabia

o Rest of MEA

Product Insights

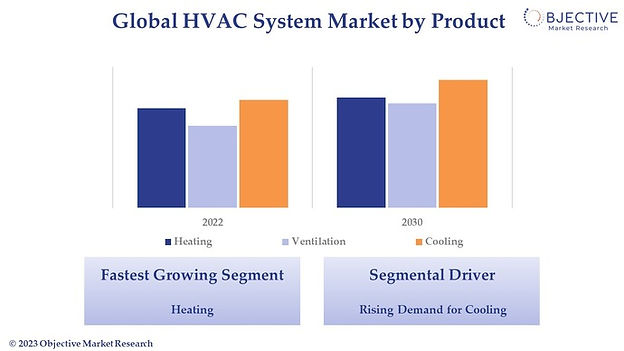

Cooling Equipment to Dethaw Market Towards Considerable Revenue Owing to Rising Environmental Temperatures

The market can be differentiated between heating, ventilation, and cooling based on product.

In 2022, the cooling subsegment of the HVAC industry generated the most income. The International Energy Agency (IEA) reports that more than 10% of global power use goes toward cooling. The numbers are staggering and likely explain why air conditioning has been the primary use for HVAC (heating, ventilation, and air conditioning) systems for so long. Demand for cooling systems like air conditioners (AC) and unitary ACs has risen thanks to rising global temperatures and incomes, especially in the world's hottest areas. All of these things should contribute to growth in the HVAC equipment market. Rising temperatures are also anticipated to boost the demand for air conditioners throughout the Middle East and Asia.

The heating industry is likewise large and has been expanding slowly over time. As the industry shifts from a fuel-based operating paradigm to efficient low-carbon solutions, the sector is expected to grow in the long run. Over the same time frame, new opportunities will open as using solar-powered heat pumps becomes more commonplace.

Application Insights

Residential Installation on the Rise Due to Increasing Developing and Developed Countries

Based on application, the global market can be broken down into residential, industrial, and commercial.

In terms of revenue, the HVAC market in 2022 was primarily driven by the residential sector. The residential HVAC industry benefits from the rise in apartment complexes and single-family homes. The demand for home HVAC (Heating, Ventilation, and Air Conditioning) systems is predicted to remain stable in established regions but somewhat increase in emerging and developing markets. This is largely attributable to the expanding middle classes of both developing and developed countries.

Huge expansion prospects exist in the commercial HVAC industry. Green and smart technologies and automated systems are two developments likely to impact the commercial HVAC industry in the coming years significantly.

Regional Insights

North America to Produce Largest Market Hold Owing to Supportive Infrastructure

The global market can be differentiated into North America, Europe, Asia Pacific, Latin America, the Middle East and Africa based on location.

Regarding HVAC systems, the Asia-Pacific region will likely dominate the worldwide industry. The reason for this is the rise in consumers' discretionary income. Manufacturers recognize the need to tailor HVAC products to certain geographic areas. India is growing as one of the top countries throughout the Asia Pacific. Manufacturers can profit from the government's FDI (foreign direct investment) programs. As a result, HVAC equipment producers like DAIKIN INDUSTRIES, Ltd., Johnson Controls, and others place a premium on R&D and production infrastructure.

Extremely chilly temperatures across most of Europe have contributed to the growth in demand for heating equipment, especially in Eastern Europe, where winter temperatures typically range from around minus six degrees Celsius to about plus three degrees Celsius (November through February). About 9 percent of the needs in nations within the European Union (EU) are met by district heating, with heat pumps serving as the primary energy source for these systems.

The North American market is forecast to expand rapidly in the following years. Rising demand from homeowners is to blame for this trend. With IoT integration, numerous manufacturers have already launched smart HVAC system offerings with green technology, interoperability with smart devices, and improved energy efficiency. Because of this, HVAC systems are expected to become increasingly popular in the coming years across the United States and Canada.

Heating, Ventilation, and Cooling (HVAC) System Industry Analysis

Many companies selling in this industry have used an inorganic expansion approach. Mergers and acquisitions (M&A) are a primary strategy for companies looking to expand their market share and one-up their competitors. OEMs focus on technology and energy efficiency as short-term goals for relevance and profit. Market participants prioritize R&D to create technologically superior and distinctive items rather than simply expanding their company's size and reach.

To avoid losing customers over regulatory issues, businesses are putting extra effort into creating items that meet the standards of local authorities. In turn, this is assisting distribution networks to spur increased sales. Daikin, for instance, is working on expanding its dealer network in Thailand and Vietnam to market its energy-efficient inverter air conditioners better.

Heating, Ventilation, and Cooling (HVAC) System Market Recent Developments

• In September 2021, Johnson Controls has announced that it will combine the new UL and SafeTraces partnership with its market-leading OpenBlue Healthy Buildings product. Science-based performance data supported by cutting-edge technology allows K-12 managers to ensure children, teachers, and staff are safe by confirming that their schools fulfill indoor air quality guidelines and reducing the likelihood of infection.

• In August 2021, Sustainable commercial buildings with drastically reduced carbon footprints were jointly developed by Trane by Trane Technologies and Nexii Building Solutions Inc. (Nexii). To cut energy consumption and carbon emissions further, the partnership combines Nexii's knowledge of high-performance and efficient building construction with Trane's digitally integrated EcoWise high-efficiency climate comfort systems.

Global Heating, Ventilation, and Cooling (HVAC) System Market Prominent Players

• Nortek Global HVAC LLC (U.S.)

• Lennox International Inc. (U.S.)

• SAMSUNG (South Korea)

• Trane (Ireland)

• Johnson Controls (Ireland)

• Daikin Industries, Ltd (Japan)

• Carrier (U.S.)

• LG Electronics (South Korea)

• Emerson Electric Co. (U.S.)

• Mitsubishi Electronics Corporation (Japan)

Frequently Asked Questions (FAQs)

At what rate will the Heating, Ventilation, and Cooling (HVAC) System Market Expand?

According to Objective Market Research, the market for heating, ventilation, and air conditioning (HVAC) systems will increase at a CAGR of 5.7% during the forecast period.

What are the factors driving the global Heating, Ventilation, and Cooling (HVAC) System Market?

The global heating, ventilation, and cooling (HVAC) system market will grow due to factors such as IoT's rapid transformation within the HVAC industry and the rising inclination towards hybrid systems.

Which segment accounted for the largest Heating, Ventilation, and Cooling (HVAC) System Market share by Application?

Regarding revenue, the residential sector was the primary driver of the HVAC market in 2022. The growth of housing developments and single-family residences benefits the residential HVAC industry.

What region holds the major share in the global market scape?

Regarding HVAC systems, Asia-Pacific is going to dominate the international market. The explanation for this is the rise in consumer discretionary income. Manufacturers acknowledge the need to customize HVAC products for specific geographic regions.

Which are the dominating players in the market during the forecast period?

Some dominant market leaders in the global heating, ventilation, and cooling (HVAC) system market are Nortek Global HVAC LLC (U.S.), Lennox International Inc. (U.S.), SAMSUNG (South Korea), Trane (Ireland), and Johnson Controls (Ireland), among others.

*Our reports are available on a region/wise and chapter/wise basis as well. For any additional personalization contact our sales representative directly at sales@objectivemarketresearch.com

Table of Content

1. Introduction

1.1 Market Definition

1.2 Objective of the Study

1.3 Market Scope

1.4 Years Considered in the Study

1.4.1 Historic Year: 2019-2021

1.4.2 Base Year: 2022

1.4.3 Forecast Period: 2023-2030

1.5 Currency Used in the Study

1.6 Boundaries for the Study

1.7 Collaborators/Stakeholders/Benefactors

2. Research Methodology

2.1 Research Outline

2.2 Data Collection Methods

2.3 Data Sources

2.3.1 Secondary Sources

2.3.1.1 Paid Sources

2.3.1.2 Unpaid Sources

2.3.2 Primary Sources

2.4 Market Estimation Methodology

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Data Triangulation

2.6 Assumptions of the Study

2.7 Limitations of the Study

3. Executive Summary

3.1 Market Outlook

3.2 Analysts Perspective

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers

4.1.1.1. Increasing Installation in the Residential Sector

4.1.1.2. Technological Advancements

4.1.2. Restrain

4.1.2.1. Lack of a Skilled Workforce

4.1.3. Opportunities

4.1.3.1. Hybrid Systems

4.1.4. Impact of Market Dynamics

4.2. Impact of COVID-19 pandemic

4.3. Value Chain Analysis

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Buyers

4.4.2. Bargaining Power of Suppliers

4.4.3. Threat of Substitution

4.4.4. Threat of New Entrants

4.4.5. Competitive Rivalry

5. Global Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, by Product from 2019-2030 (in USD million) (Units)

6. Global Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, by Construction from 2019-2030 (in USD million) (Units)

6.1. New

6.2. Retrofit

7. Global Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, by Application from 2019-2030 (in USD million) (Units)

7.1. Residential

7.2. Industrial

7.3. Commercial

8. Global Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, by Region from 2019-2030 (in USD million) (Units)

8.1. North America

8.1.1. North America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Country

8.1.1.1. U.S.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. North America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Product

8.1.3. North America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Construction

8.1.4. North America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Application

8.2. Europe

8.2.1. Europe Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Country

8.2.1.1. Germany

8.2.1.2. UK

8.2.1.3. France

8.2.1.4. Spain

8.2.1.5. Italy

8.2.1.6. Rest of Europe (RoE)

8.2.2. Europe Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Product

8.2.3. Europe Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Construction

8.2.4. Europe Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Application

8.3. Asia-Pacific (APAC)

8.3.1. Asia-Pacific Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Country

8.3.1.1. Japan

8.3.1.2. China

8.3.1.3. India

8.3.1.4. South Korea

8.3.1.5. Rest of the APAC

8.3.2. Asia-Pacific Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Product

8.3.3. Asia-Pacific Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Construction

8.3.4. Asia-Pacific Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Application

8.4. Latin America

8.4.1. Latin America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Country/Region

8.4.1.1. Argentina

8.4.1.2. Brazil

8.4.1.3. Rest of Latin America

8.4.2. Latin America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Product

8.4.3. Latin America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Construction

8.4.4. Latin America Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Application

8.5. Middle East & Africa

8.5.1. Middle East & Africa Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecasts, By Country/Region

8.5.1.1. South Africa

8.5.1.2. UAE

8.5.1.3. Saudi Arabia

8.5.1.4. Rest of Middle East & Africa

8.5.2. Middle East & Africa Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Product

8.5.3. Middle East & Africa Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Construction

8.5.4. Middle East & Africa Heating, Ventilation, and Cooling (HVAC) System Market Analysis & Forecast, By Application

9. Competitive Landscape

9.1. Market Share Analysis (2022)

9.2. Market Positioning of Top Players (2022)

9.3. Key Developments & Growth Strategies (2020-2022)

9.3.1. Product Launches

9.3.2. Merges, Collaborations & Agreements

9.3.3. Expansion

9.4. SWOT Analysis

10. Company Profiles (Business Overview, Products Offered, Financial Details*, Recent Developments)

10.1. Nortek Global HVAC LLC (U.S.)

10.1.1. Company Snapshot

10.1.2. Business Overview

10.1.3. Financial Data

10.1.4. Key Products Offered

10.1.5. Recent Developments

10.2. Lennox International Inc. (U.S.)

10.3. SAMSUNG (South Korea)

10.4. Trane (Ireland)

10.5. Johnson Controls (Ireland)

10.6. Daikin Industries, Ltd (Japan)

10.7. Carrier (U.S.)

10.8. LG Electronics (South Korea)

10.9. Emerson Electric Co. (U.S.)

10.10. Mitsubishi Electronics Corporation (Japan)

10.11. Others

11. Appendix

11.1. Currency Exchange Rate to USD

11.2. Abbreviations

* Financial details captured might be subjected to information available and not be given for privately-held companies or for companies that do not report it in the public domain