Analysis of the Sleep Apnea Devices Market: Assessment of Market Size, Trends, Statistics, and Competitors

Global Sleep Apnea Devices Market by Product Type (Diagnostic Devices, Therapeutic Devices, and Sleep Apnea Masks), by End User (Sleep Laboratories & Clinics, Homecare, and Other Settings), and by Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Size, Share, COVID-19 Impact, Regional Analysis & Forecast Till 2030

Category - Healthcare

Report Code - OMR-H-279

Format: PDF, PPT, and Excel

Sleep Apnea Devices Market Overview

Sleep apnea is characterized by many interruptions in breathing throughout the night. This can reduce the amount of oxygen reaching your cells. Recurrent total or partial collapse of the upper airway throughout sleep defines obstructive sleep apnea (OSA), a disease characterized by obstructive apneas, hypopneas, or respiratory effort-related arousals (RERAs). According to some estimates, 15–30% of males and 5–15% of females in the overall adult population have obstructive sleep apnea (OSA). Increasing numbers of people are developing OSA due to a shift toward sedentary lifestyles, an aging population, and the growing incidences of chronic diseases. Lack of awareness and subpar presentation of OSA contribute to the underdiagnosis of apnea's steadily rising prevalence among the elderly. The rising number of elderly worldwide will likely increase the incidence of sleep problems. CPAP machines are considered the gold standard for treating sleep apnea. Some of the wide range of sizes and designs among these devices. Brand name, product category, and optional extras all impact the final pricing. However, the retail price of a CPAP machine might range from USD 250 to USD 1,000 or more. In turn, this slows the expansion of the market. Therefore, businesses should collaborate with industry professionals to develop cost-effective new products. Demand for these tools increased worldwide after the COVID-19 epidemic, a completely unexpected and shocking development. This market's demand and growth are responsible for the slowdown in CAGR; after the epidemic, they will rise to where they were before.

Sleep Apnea Devices Market Growth Factors

Growing Prevalence of OSA to Aid Market Growth

One-third of the population will experience a sleep issue at some point, making it one of the most prevalent and problematic medical problems. It is common for sleep apnea, a potentially fatal sleep disorder, to go undetected and untreated. Patients with OSA are benefiting from several government-sponsored programs, though. Startups trying to manage and prevent sleep disorders have the backing of governments in both developing and developed nations. These new companies are developing patient-specific monitoring tools, applications, and treatments to deliver to people worldwide. The aging population largely fuels increased demand for sleep apnea treatment. This condition is particularly common in the elderly. The United Nations estimates that in 2019, 703 million people worldwide will be 65 or older. World Health Organization (WHO) projections also show that by 2050, people aged 60 and up will have doubled from its 2015 level, reaching 2 billion. It is estimated that between 13% and 32% of the world's elderly population will have OSA by 2020. Therefore, it is expected that the growing elderly population and more awareness would increase the use of sleep apnea devices.

Rising Adoption of Technological Advanced Products to Augment Market Growth

The development of new alternatives for treating sleep apnea has been greatly aided by the shift of patients toward adopting technologically advanced devices. For instance, the usage of oral products that include the mandibular advancement device (MAD) for Apnea therapy has increased due to the discomfort produced by CPAP devices in patients. Additionally, it is projected that the acceptance rate for CPAP equipment among users has decreased by up to 50.0%, according to data revealed by NCBI from various studies in different countries. This has caused the market to introduce alternatives like oral appliances, which have proven to be efficient and provide relief to patients throughout the treatment of the disorder. Additionally, the non-invasive nature of the actinometer and its lower price, compared to conventional polysomnography devices (PSG), has made it extremely popular among sleep clinics. As a result, patients increasingly turn to oral appliances & actinometers for efficient sleep apnea treatment due to rising failure to adhere to CPAP devices and high demand for affordable diagnostic devices.

Sleep Apnea Devices Industry Segmentation

Product Type

• Diagnostic Devices

o Actigraphs

o Polysomnography (PSG) device

o Respiratory Polygraphs

o Pulse Oximeters

• Therapeutic Devices

o Positive Airway Pressure (PAP) Devices

CPAP

APAP

Bi-PAP

o Oral Devices

o Nasal Devices

o Chin Straps

• Sleep Apnea Masks

End Users

• Sleep Laboratories & Clinics

• Homecare

• Other Settings

Sleep Apnea Devices Market Regional Segmentation

North America

o U.S.

o Canada

o Mexico

Europe

o Germany

o U.K.

o France

o Spain

o Italy

o Rest of Europe (RoE)

Asia Pacific (APAC)

o Japan

o China

o India

o South Korea

o Rest of APAC

Latin America

o Argentina

o Brazil

o Rest of Latin America

Middle East & Africa

o South Africa

o UAE

o Saudi Arabia

o Rest of MEA

Product Type Insights

Therapeutic Devices Dominated Owing to Rising Awareness Among Patients

The product type segment can be categorized between diagnostic devices, therapeutic devices, and sleep apnea masks.

The therapeutic devices segment is anticipated to grow the fastest throughout the foreseen period. Growing public awareness regarding these disorders and the availability of highly advanced technological devices are key factors boosting the market growth. The increasing number of government initiatives and patient commitment to effective care are expected to create lucrative opportunities for device manufacturers, further expanding the market.

The sleep apnea masks segment is anticipated to expand at the fastest CAGR during the projected period. Major drivers influencing the segment's growth include the widespread use of sleep apnea masks, rising incidence of comorbidities linked to OSA, and increased CPAP machine adoption rates for disease treatment.

Regional Insights

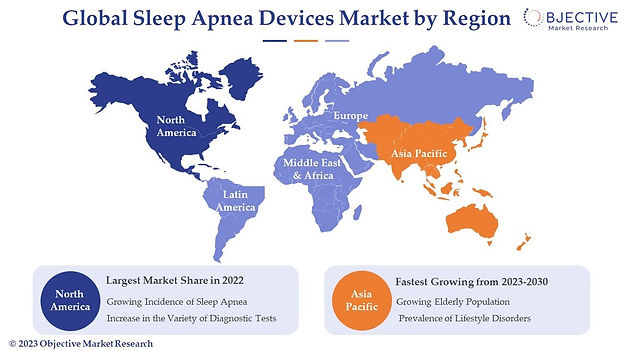

North America to Lead Global Sleep Apnea Devices Market Due to the Growing Number of OSA Patients

Based on region, the market can be split between North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America is anticipated to continue to be the largest sleep apnea devices market over the next few years. The market is projected to be boosted by the growing incidence of sleep apnea due to several underlying diseases, including depression and anxiety, technological developments, and the introduction of products backed by extensive research. Sleep apnea affects between 3%-7% of males and 2%-5% of women in the United States, per the American Academy of Sleep Medicine (AASM) data. Furthermore, many individuals are concerned about the health risks connected with sleep apnea, leading to a rapid increase in the variety of diagnostic tests to determine the occurrence of sleep apnea in the region.

Asia Pacific is projected to grow at the fastest CAGR during the next few years. The expanding elderly population and prevalence of lifestyle disorders such as cardiovascular disease, cancer, diabetes, hypertension, and chronic respiratory disease in the Asia Pacific are expected to drive the region's rapid growth over the projection period. One-third of Singaporeans have moderate-to-severe OSA, while up to one-tenth of Singaporeans suffer from severe apnea, according to a study supported by the JurongHealth Services Research and Quality Improvement Grant. The Chinese and Malays also had higher incidences of OSA than Indians, according to the study.

Europe is likely to be the second-largest market share due to the rapid adoption of these devices and the wide spread of information about sleep apnea. Profitable opportunities for device producers are expected to increase due to the availability of technologically improved gadgets, the increasing number of local government activities, and patients' dedication to receiving effective care.

Sleep Apnea Devices Industry Analysis

The major companies consistently concentrate on new and improved product development techniques to stay ahead of the competition and broaden their customer bases. Companies are planning mergers, acquisitions, and partnerships to meet the needs of a rising client base.

Major companies are consistently concentrating on new and improved product development techniques. Companies are planning mergers, acquisitions, and partnerships to meet the needs of a rising client base.

Sleep Apnea Devices Market Recent Developments

• In October 2022, Fisher & Paykel Healthcare paid USD 405 million to purchase Provent Sleep Apnea Therapy. With this purchase, Fisher & Paykel will access Provent's sleep apnea products, including the company's line of disposable nasal devices.

• In November 2022, Primasun is an end-to-end solution unveiled by ResMed and Alphabet's life science subsidiary Verily to assist employers and healthcare professionals identify people at risk for complicated sleep problems.

• In December 2022, Covidien paid USD 470,000,000 to acquire Puritan Bennett. Due to the acquisition, Covidien can now access Puritan Bennett's CPAP and BiPAP sleep apnea equipment.

Global Sleep Apnea Devices Market Prominent Players

• GE HealthCare (U.S.)

• Koninklijke Philips N.V. (Netherlands)

• Cadwell Industries Inc. (U.S.)

• Fisher & Paykel Healthcare Limited (New Zealand)

• ResMed (U.S.)

• SOMNOmedicsGmbH (Germany)

• Invacare Corporation (U.S.)

• Natus Medical Incorporated. (U.S.)

• Compumedics Limited (Australia)

• BMC (China)

• BD (U.S.)

• LivaNova PLC (UK)

Frequently Asked Questions (FAQs)

At what rate will the Sleep Apnea Devices Market Expand?

According to Objective Market Research, the market for sleep apnea devices would grow at a CAGR of 7.2% over the forecast period.

What are the factors driving the global Sleep Apnea Devices market?

The rising prevalence of sleep apnea, aging populations, rising rates of obesity and hypertension, and growing patient awareness in developing regions are all expected to fuel market growth over the next few years.

Which product type accounted for the largest Sleep Apnea Devices market share by product type?

Therapeutic devices are expected to dominate the largest market share during the forecast period due to the growing prevalence of OSA and rising patient awareness.

What region holds the major share in the global market scape?

Asia Pacific will hold the largest market share owing to the rising incidence of sleep apnea among the population.

Which are the dominating players in the market during the forecast period?

Some of the prominent players in the global Sleep, Apnea Devices market are GE HealthCare (U.S.), Koninklijke Philips N.V. (Netherlands), Cadwell Industries Inc. (U.S.), Fisher & Paykel Healthcare Limited (New Zealand), ResMed (U.S.), SOMNOmedicsGmbH (Germany), Invacare Corporation (U.S.), Natus Medical Incorporated. (U.S.), Compumedics Limited (Australia), BMC (China), BD (U.S.), and LivaNova PLC (UK), among others.

*Our reports are available on a region/wise and chapter/wise basis as well. For any additional personalization contact our sales representative directly at sales@objectivemarketresearch.com

Table of Content

1. Introduction

1.1 Market Definition

1.2 Objective of the Study

1.3 Market Scope

1.4 Years Considered in the Study

1.4.1 Historic Year: 2019-2021

1.4.2 Base Year: 2022

1.4.3 Forecast Period: 2023-2030

1.5 Currency Used in the Study

1.6 Boundaries for the Study

1.7 Collaborators/Stakeholders/Benefactors

2. Research Methodology

2.1 Research Outline

2.2 Data Collection Methods

2.3 Data Sources

2.3.1 Secondary Sources

2.3.1.1 Paid Sources

2.3.1.2 Unpaid Sources

2.3.2 Primary Sources

2.4 Market Estimation Methodology

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Data Triangulation

2.6 Assumptions of the Study

2.7 Limitations of the Study

3. Executive Summary

3.1 Market Outlook

3.2 Analysts Perspective

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers

4.1.1.1. Rising Geriatric Population

4.1.1.2. Growing Prevalence of Apnea

4.1.2. Restrain

4.1.2.1. Higher Cost of CPAP Devices

4.1.3. Opportunities

4.1.3.1. Increasing Awareness Among the Patient Population

4.1.4. Impact of Market Dynamics

4.2. Impact of COVID-19 pandemic

4.3. Value Chain Analysis

4.4. Porter’s Five Forces Analysis

4.4.1. Bargaining Power of Buyers

4.4.2. Bargaining Power of Suppliers

4.4.3. Threat of Substitution

4.4.4. Threat of New Entrants

4.4.5. Competitive Rivalry

5. Global Sleep Apnea Devices Market Analysis & Forecast, by Product Type from 2019-2030 (in USD million)

5.1. Diagnostic Devices

5.1.1. Actigraphs

5.1.2. Polysomnography (PSG) device

5.1.3. Respiratory Polygraphs

5.1.4. Pulse Oximeters

5.2. Therapeutic Devices

5.2.1. Positive Airway Pressure (PAP) Devices

5.2.1.1. CPAP

5.2.1.2. APAP

5.2.1.3. Bi-PAP

5.2.2. Oral Devices

5.2.3. Nasal Devices

5.2.4. Chin Straps

5.3. Sleep Apnea Masks

6. Global Sleep Apnea Devices Market Analysis & Forecast, by End User from 2019-2030 (in USD million)

6.1. Sleep Laboratories & Clinics

6.2. Homecare

6.3. Other Settings

7. Global Sleep Apnea Devices Market Analysis & Forecast, by Region from 2019-2030 (in USD million)

7.1. North America

7.1.1. North America Sleep Apnea Devices Market Analysis & Forecast, By Country

7.1.1.1. U.S.

7.1.1.2. Canada

7.1.1.3. Mexico

7.1.2. North America Sleep Apnea Devices Market Analysis & Forecast, By Product Type

7.1.3. North America Sleep Apnea Devices Market Analysis & Forecast, By End User

7.2. Europe

7.2.1. Europe Sleep Apnea Devices Market Analysis & Forecast, By Country

7.2.1.1. Germany

7.2.1.2. UK

7.2.1.3. France

7.2.1.4. Spain

7.2.1.5. Italy

7.2.1.6. Rest of Europe (RoE)

7.2.2. Europe Sleep Apnea Devices Market Analysis & Forecast, By Product Type

7.2.3. Europe Sleep Apnea Devices Market Analysis & Forecast, By End User

7.3. Asia-Pacific (APAC)

7.3.1. Asia-Pacific Sleep Apnea Devices Market Analysis & Forecast, By Country

7.3.1.1. Japan

7.3.1.2. China

7.3.1.3. India

7.3.1.4. South Korea

7.3.1.5. Rest of the APAC

7.3.2. Asia-Pacific Sleep Apnea Devices Market Analysis & Forecast, By Product Type

7.3.3. Asia-Pacific Sleep Apnea Devices Market Analysis & Forecast, By End User

7.4. Latin America

7.4.1. Latin America Sleep Apnea Devices Market Analysis & Forecast, By Country/Region

7.4.1.1. Argentina

7.4.1.2. Brazil

7.4.1.3. Rest of Latin America

7.4.2. Latin America Sleep Apnea Devices Market Analysis & Forecast, By Product Type

7.4.3. Latin America Sleep Apnea Devices Market Analysis & Forecast, By End User

7.5. Middle East & Africa

7.5.1. Middle East & Africa Sleep Apnea Devices Market Analysis & Forecast, By Country/Region

7.5.1.1. South Africa

7.5.1.2. UAE

7.5.1.3. Saudi Arabia

7.5.1.4. Rest of Middle East & Africa

7.5.2. Middle East & Africa Sleep Apnea Devices Market Analysis & Forecast, By Product Type

7.5.3. Middle East & Africa Sleep Apnea Devices Market Analysis & Forecast, By End User

8. Competitive Landscape

8.1. Market Share Analysis (2022)

8.2. Market Positioning of Top Players (2022)

8.3. Key Developments & Growth Strategies (2020-2022)

8.3.1. Product Launches

8.3.2. Merges, Collaborations & Agreements

8.3.3. Expansion

8.4. SWOT Analysis

9. Company Profiles (Business Overview, Products Offered, Financial Details*, Recent Developments)

9.1. GE HealthCare (U.S.)

9.1.1. Company Snapshot

9.1.2. Business Overview

9.1.3. Financial Data

9.1.4. Key Products Offered

9.1.5. Recent Developments

9.2. Koninklijke Philips N.V. (Netherlands)

9.3. Cadwell Industries Inc. (U.S.)

9.4. Fisher & Paykel Healthcare Limited (New Zealand)

9.5. ResMed (U.S.)

9.6. SOMNOmedicsGmbH (Germany)

9.7. Invacare Corporation (U.S.)

9.8. Natus Medical Incorporated. (U.S.)

9.9. Compumedics Limited (Australia)

9.10. BMC (China)

9.11. BD (U.S.)

9.12. LivaNova PLC (UK)

9.13. Others

10. Appendix

10.1. Currency Exchange Rate to USD

10.2. Abbreviations

* Financial details captured might be subjected to information available and not be given for privately-held companies or for companies that do not report it in the public domain